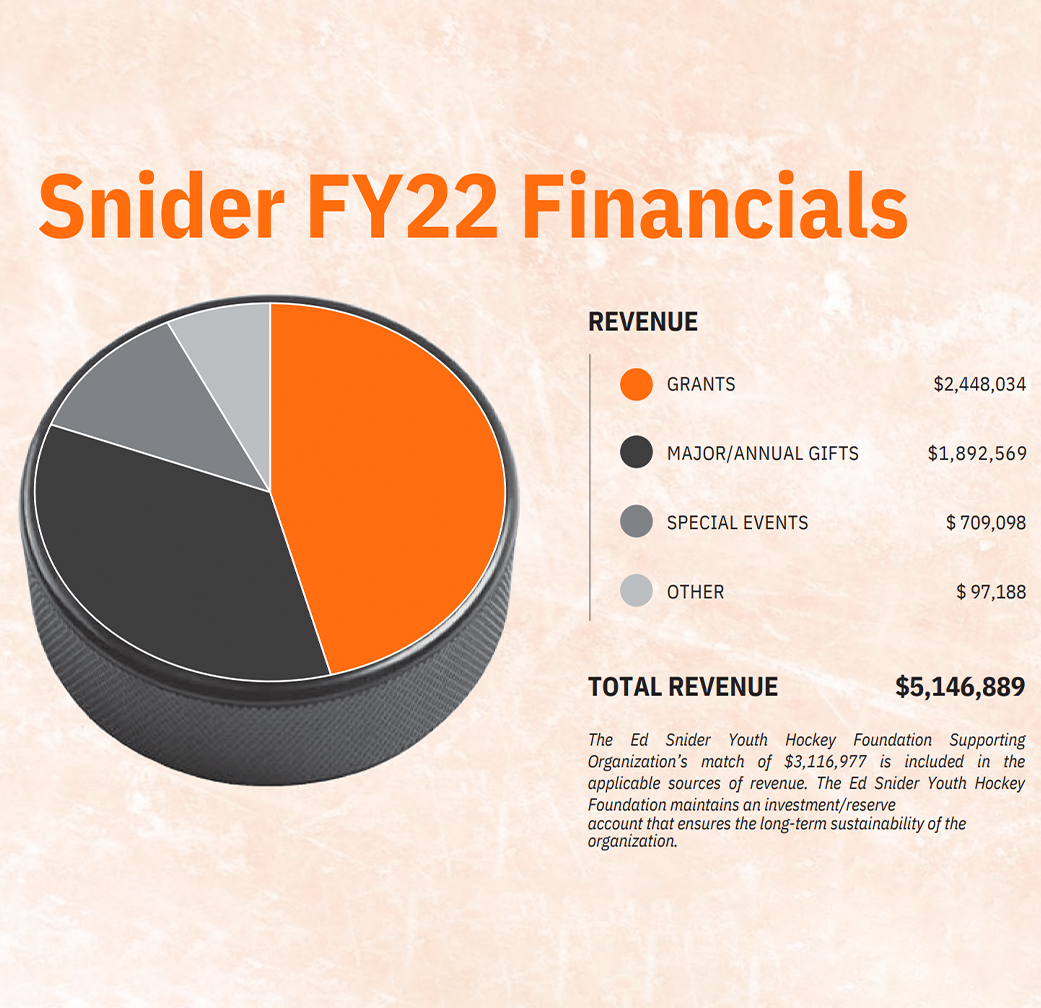

Make a One-Time Donation

Donate online, honor a loved one via a tribute gift, give through your Donor Advised Fund (DAF), gift a stock contribution, or make a matching company donation. Contact Katy Hsieh | [email protected] for details about your unique gift to Snider.