Scholarship Programs

High School Scholarships

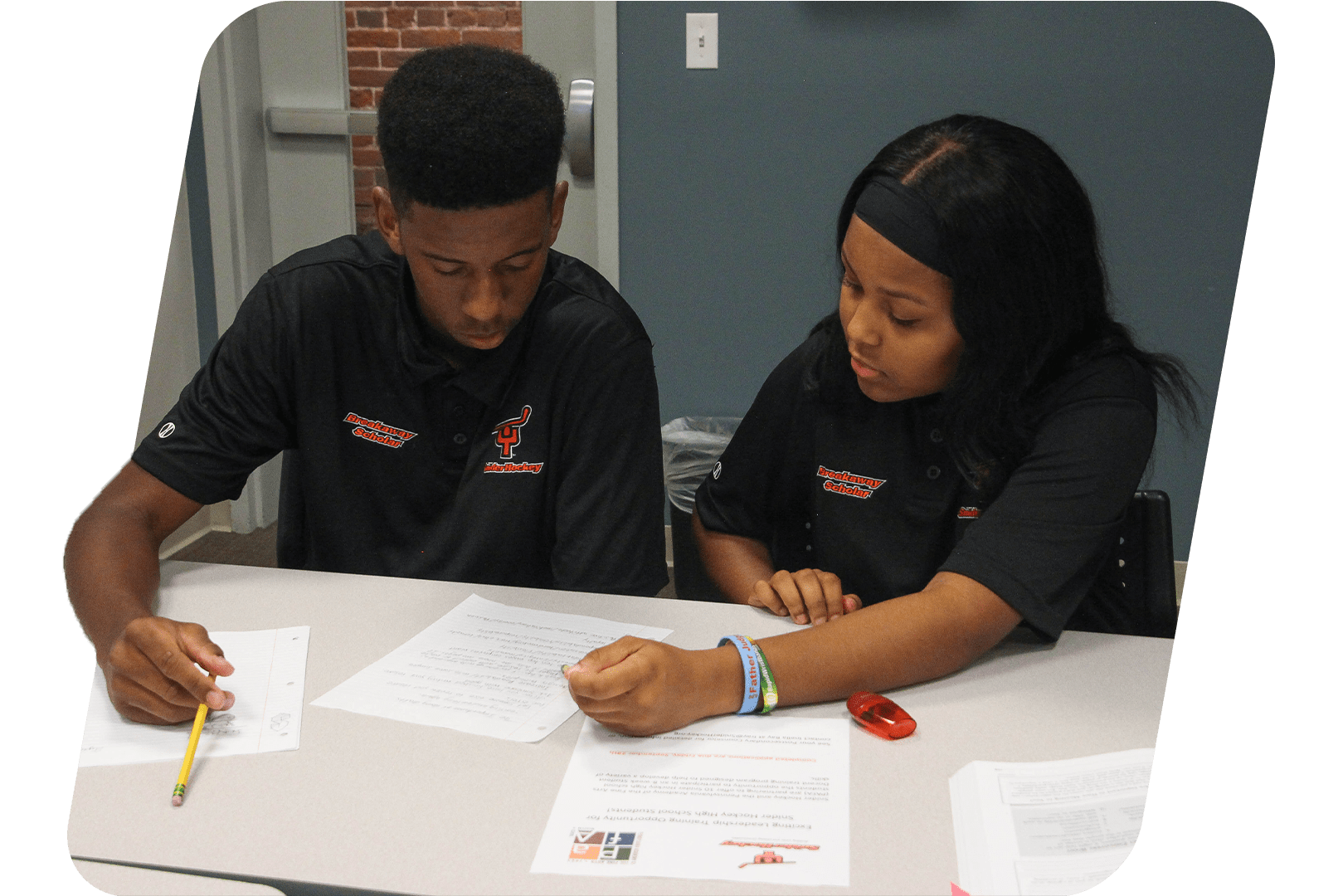

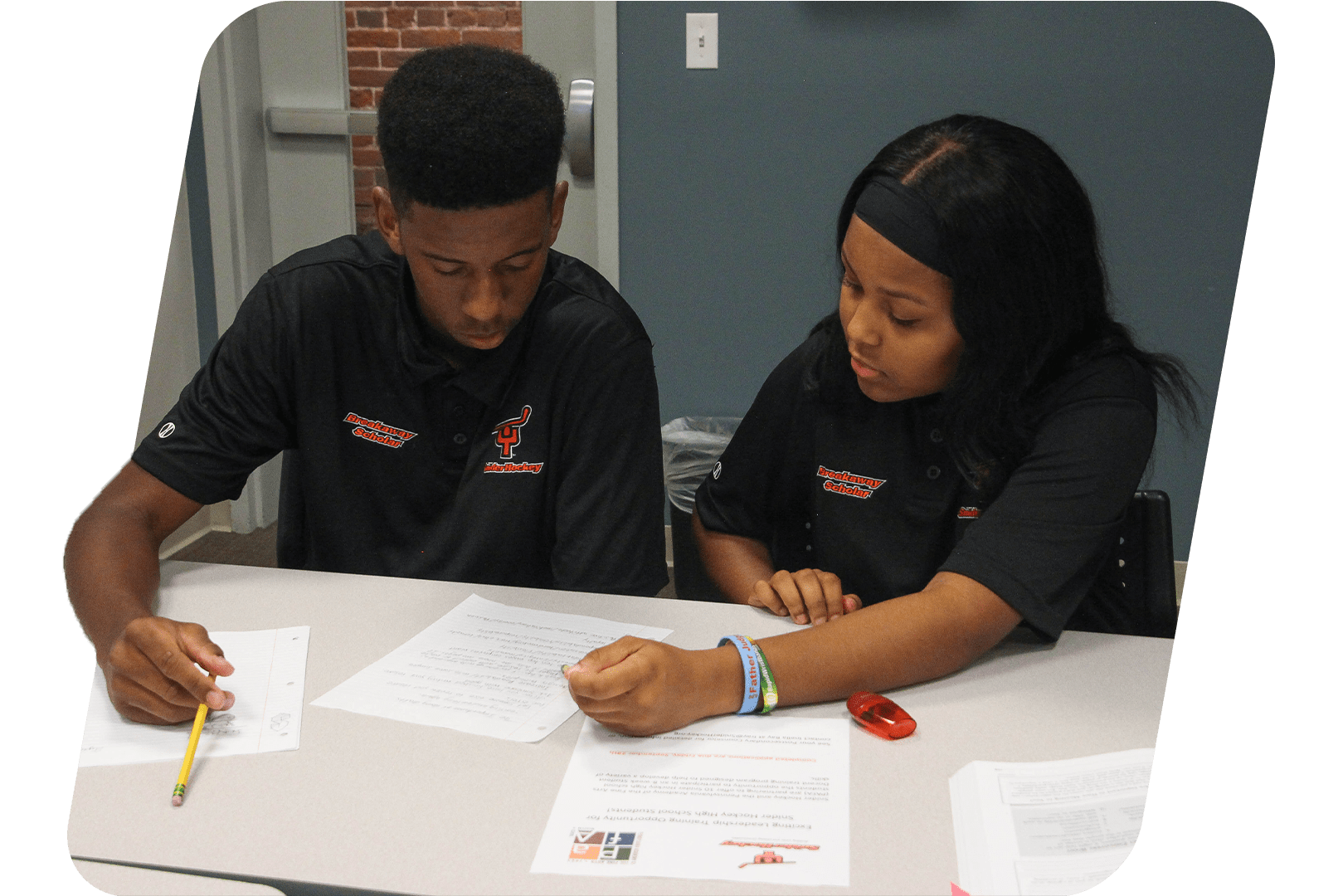

Students accepted into the Breakaway Scholarship program during their final year of middle school will receive a one-year scholarship to cover full or partial tuition and school fees at one of Snider’s partner high-performing private and vocational secondary schools. This scholarship is renewable for up to three additional years if students continue to meet eligibility criteria.

Students interested in the program meet with advisors and counselors who guide them through the application process. Information sessions and webinars are offered to students and families throughout the 8th grade school year.

Current Partner Schools

Snider currently partners with eighteen high-performing high schools who offer enhanced academic opportunities and a wide variety of athletics, programming, and activities.

- Archbishop Carroll High School

- Archbishop Ryan High School

- Archbishop Wood High School

- Bishop Shanahan High School

- Cardinal O’Hara High School

- Conwell-Egan High School

- Cristo Rey Philadelphia High School

- Father Judge High School

- Lansdale Catholic High School

- Ligouri Academy

- Little Flower High School

- Mercy Career & Technical High School

- Monsignor Bonner & Archbishop Prendergast High School

- Pope John Paul II High School

- Roman Catholic High School

- Ss. John Neumann and Maria Goretti Catholic High School

- St. Hubert High School

- St. Joseph’s Preparatory School

- West Catholic Preparatory High School

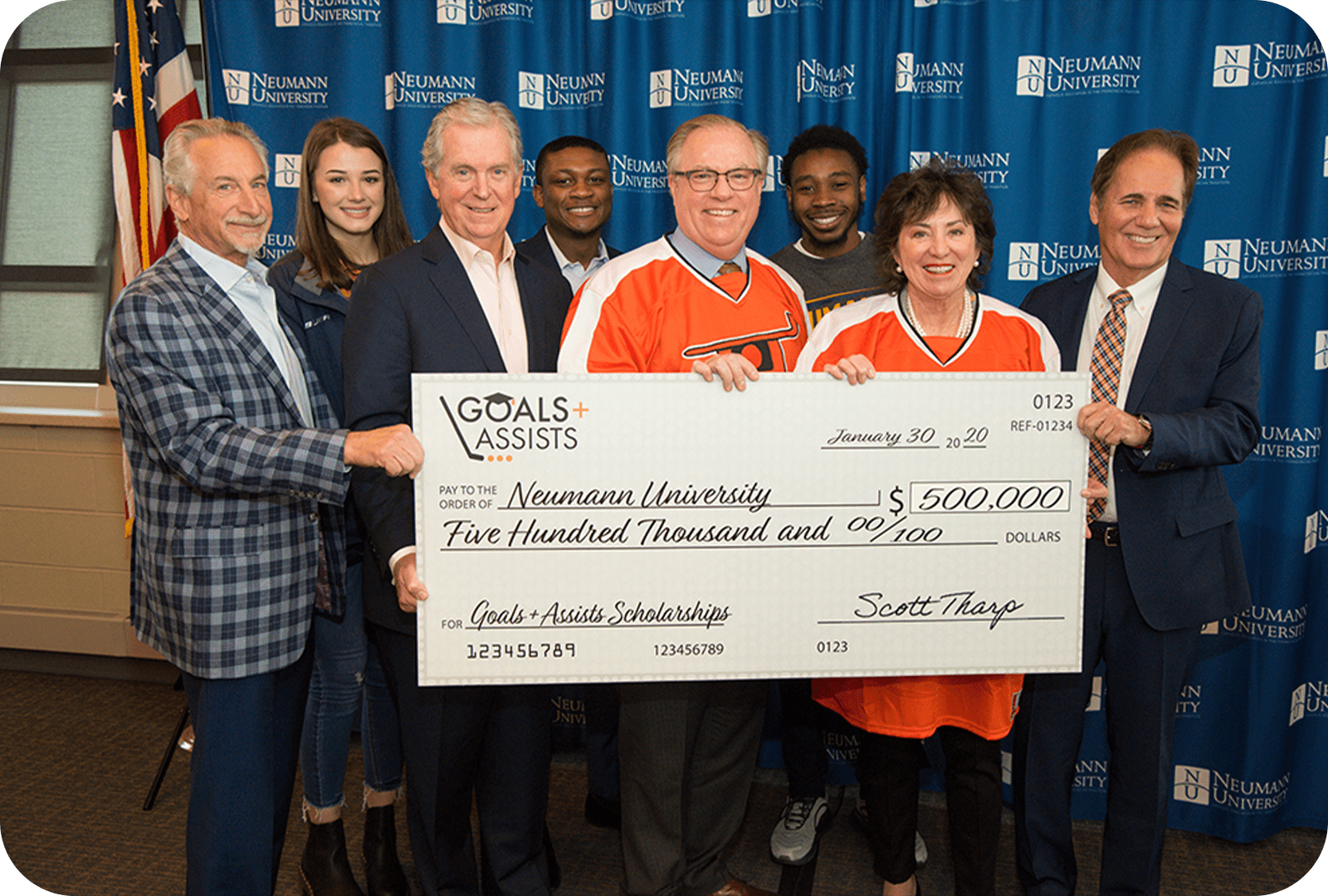

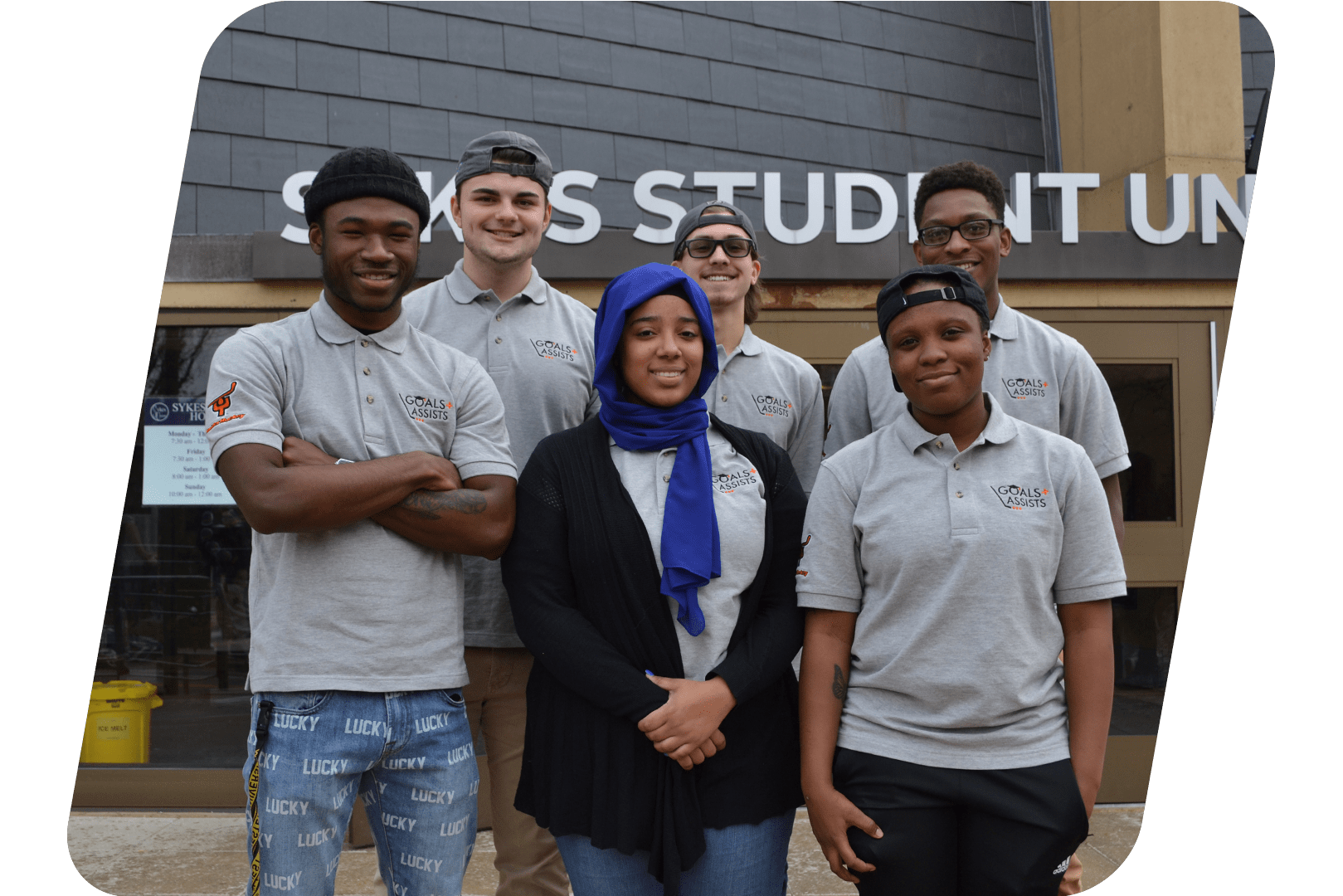

High school students who successfully complete preparation programs become Goals & Assists Scholars. Goals & Assists scholarships cover university tuition and school fees, plus room & board, allowing students to graduate debt-free.

- Community College of Philadelphia

- Elizabethtown College

- Kutztown University

- Neumann University

- St. Joseph’s University

- University of Pennsylvania

- Villanova University

- West Chester University

- Williamson College of the Trades

- Zip Code Wilmington

Interested in becoming one of Snider’s partner schools that offer Ed Snider Youth Hockey & Education students educational scholarships?