Learn More about EITC

What is the EITC Program?

The Educational Improvement Tax Credit (EITC) program provides tax credits to eligible businesses contributing to a participating Educational Improvement Organization (EIO). This program was created to provide an incentive for charitable giving by Pennsylvania businesses.

Upon approval, the taxpayer can receive a credit for between 75% – 90% of their Pennsylvania state tax liability by making a contribution to Snider.

USES

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

BUSINESS ELIGIBILITY

Any Pennsylvania business (other than a Sole Proprietorship) that pay any of the following taxes are eligible to participate in the EITC program:

- Personal Income Tax of S Corp Shareholders or Partnership Partners

- Corporate Net Income Tax

- Capital Stock Franchise Tax

- Bank & Trust Company Shares Tax

- Insurance Premium Tax

- Title Insurance Company Shares Tax

- Mutual Thrift Institutions Tax

- Malt Beverage Tax

Why Support Snider through EITC?

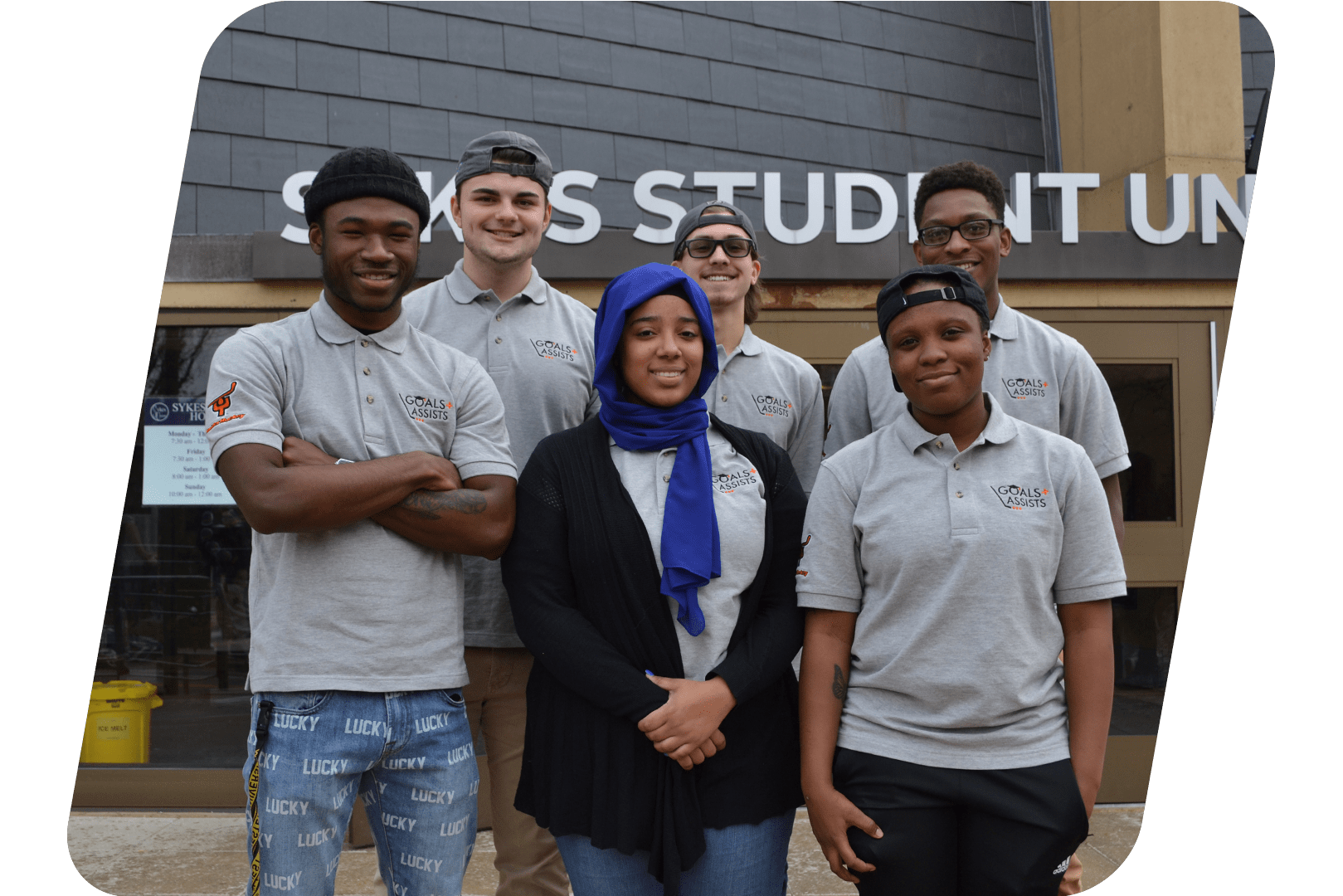

Snider is more than a hockey organization. Hockey is just our “hook” used to capture the attention of our students. Your support will benefit a wide array of programming including education, life skills hockey, mentorship, scholarship, and career exploration programming.

Know that your investment is wise! Your EITC dollars will be subject to the 2:1 match from the Support Organization that our founder, Ed Snider, set up prior to his death, thereby tripling your impact on our youth!

How to Apply

Your business receives a tax credit approval letter from the State.

Your business makes its gift to Snider within 60 days of receiving its tax credit approval letter.

Snider receives the gift, and your business provides proof of the gift to the State within 90 days of receiving the tax credit approval letter.

File your business tax returns normally.

Intersted In learning more?

Contact Chief Development Strategist, Summer Haran, at [email protected] for more information about the EITC program.