Worst nationwide

PA’s racial & economic disparities in access to educational opportunity.

K-8 Philadelphia Public Schools

Featured on the state’s list of lowest performing schools.

SNIDER GRADE-TO-GRADE MATRICULATION RATE

Students in our program remain on-track for on-time graduation.

Snider Youth Earn A’s & B’s each marking period

The majority of students show improvement each marking period.

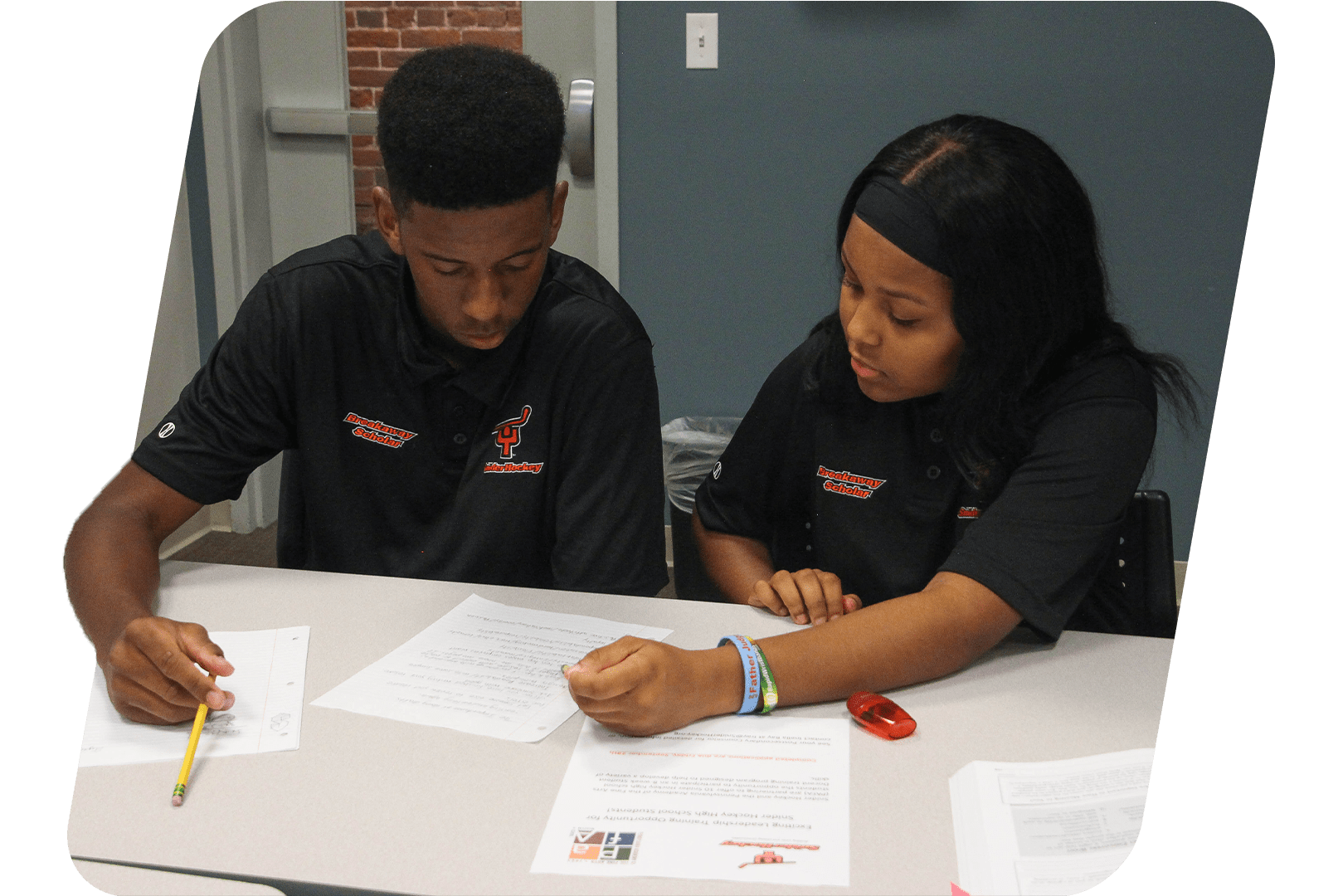

A Win-WIn for you and Inner-City Youth

Individuals can directly impact the education of a child and receive up to a 90% tax credit for their donations. The Pennsylvania educational tax credit programs (EITC/OSTC) incentivize donors to transform their tax dollars into scholarships for students to attend high-performing, quality, tuition-based schools. Invest in Philadelphia children while lowering your state and federal tax liability.

How to Turn Your Tax Liability into Scholarships

Make a 2-year commitment (minimum of $5,000 per year) to a scholarship donation through BLOCS by redirecting your PA state tax liability.

Sign the LLC agreement and write your check to BLOCS, noting that it’s designated for a Snider student. BLOCS disperses the funds to a Snider Breakaway Scholar’s school of your choice.

BLOCS provides you with a K-1 for your donation, and your 90% tax credit is issued to you by the state.

What types of taxes can be offset by this credit?

Individuals who pay PA income taxes and businesses that are authorized to do business in PA who are subject to one or more of the following taxes:

- Personal Income Tax, Sub-chapter S-corporations and other “pass-through” entities will be able to use the credit against the shareholders’, members’, or partners’ PA personal income taxes

- Corporate Net Income Tax

- Malt Beverage Tax

- Bank and Trust Company Shares Tax

- Insurance Premiums Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Institutions Ta

- Title Insurance Companies Shares Tax

- Retaliatory Fees under Section 212 of the Insurance Company Law of 1921

Intersted In learning more?

Contact Senior Vice President of Development, Katy Hsieh, at [email protected] to get started or if you’re interested in learning more.